for everyday people who want real progress

breakthrough Money School

monthly money workshops + on demand learning vault

What's Inside Breakthrough Money School?

The Vault

On-Demand Access to Past Trainings, Ebooks, Templates & Finance Resources and Business Resources.

Live Monthly Workshops

Each month we host a minimum of (3) 60-minute deep dives on various topics such as budgeting, debt payoff, investing, bookkeeping, passive income, and more.

10% For Tomorrow: A Breakthrough Project

A weekly commitment to your future self. Each week I invest 10% of my income, share the process and invite you to join in on the journey.

Upcoming Live Workshops

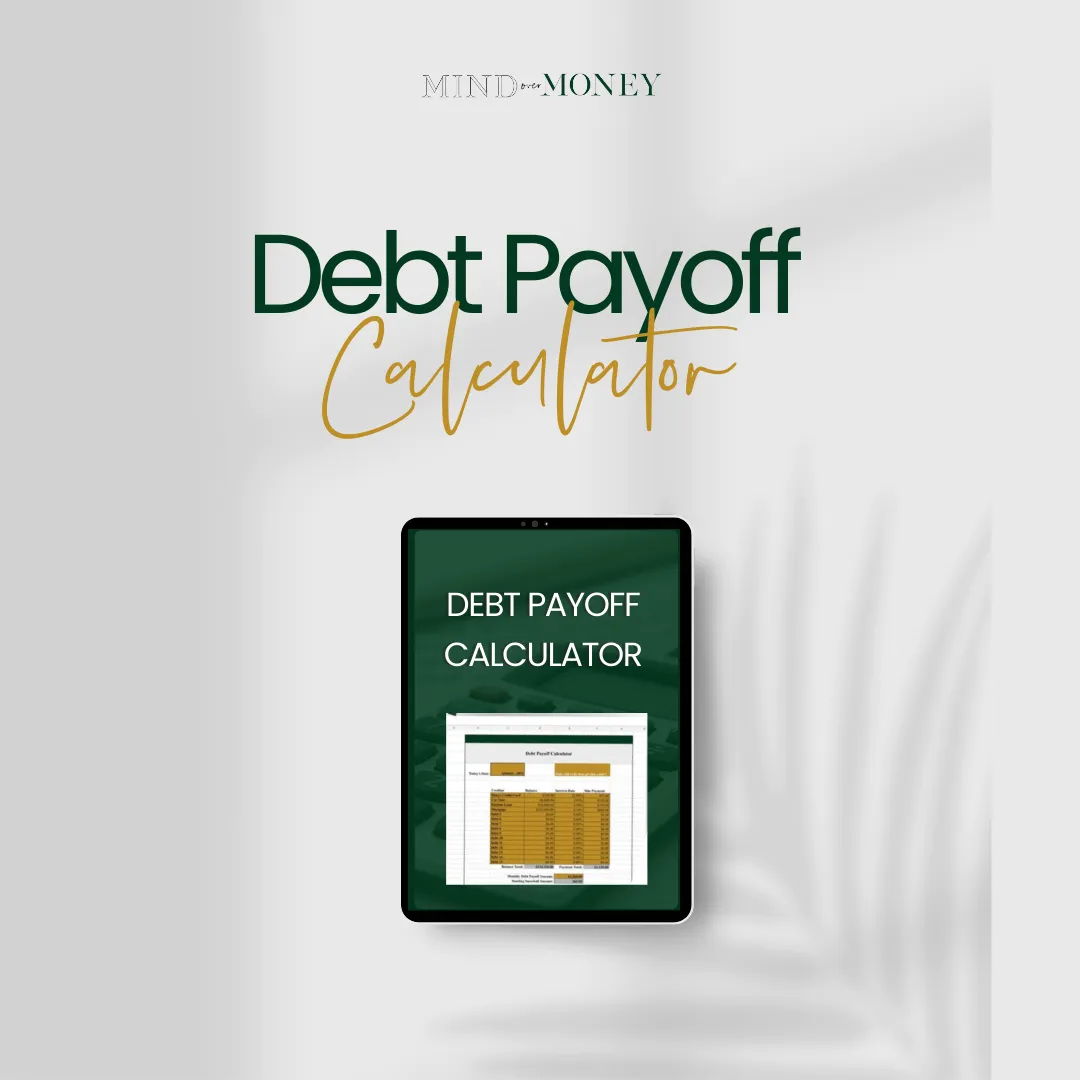

What You"ll Walk Away With

A realistic debt payoff timeline you can actually stick to

A step-by-step system to prioritize high-interest vs. low-balance debts

A proven structure for combining snowball + avalanche methods

A custom plan that doesn’t feel restrictive or shame-based

Tools to stay consistent even when income fluctuates

Who is This Workshop For?

People juggling multiple debts with no clear plan

Anyone tired of living paycheck to paycheck because of credit payments

Those who want to pay down debt without sacrificing joy

Beginners or returners to financial planning

Side hustlers, educators, creatives, and everyday earners who want peace of mind

What You"ll Walk Away With

A clear understanding of how the stock market works

Confidence in starting your first investment account

A breakdown of Roth IRAs, 401(k)s, ETFs, and index funds

A weekly investing plan (even if you start with $10/week)

Step-by-step instruction to open an account and start investing

Who is This Workshop For?

Beginners who feel overwhelmed by investing lingo

Folks who want to build wealth but don’t know where to start

Anyone tired of feeling behind in building for the future

Side hustlers and freelancers with inconsistent income

People who want to pass down wealth and knowledge

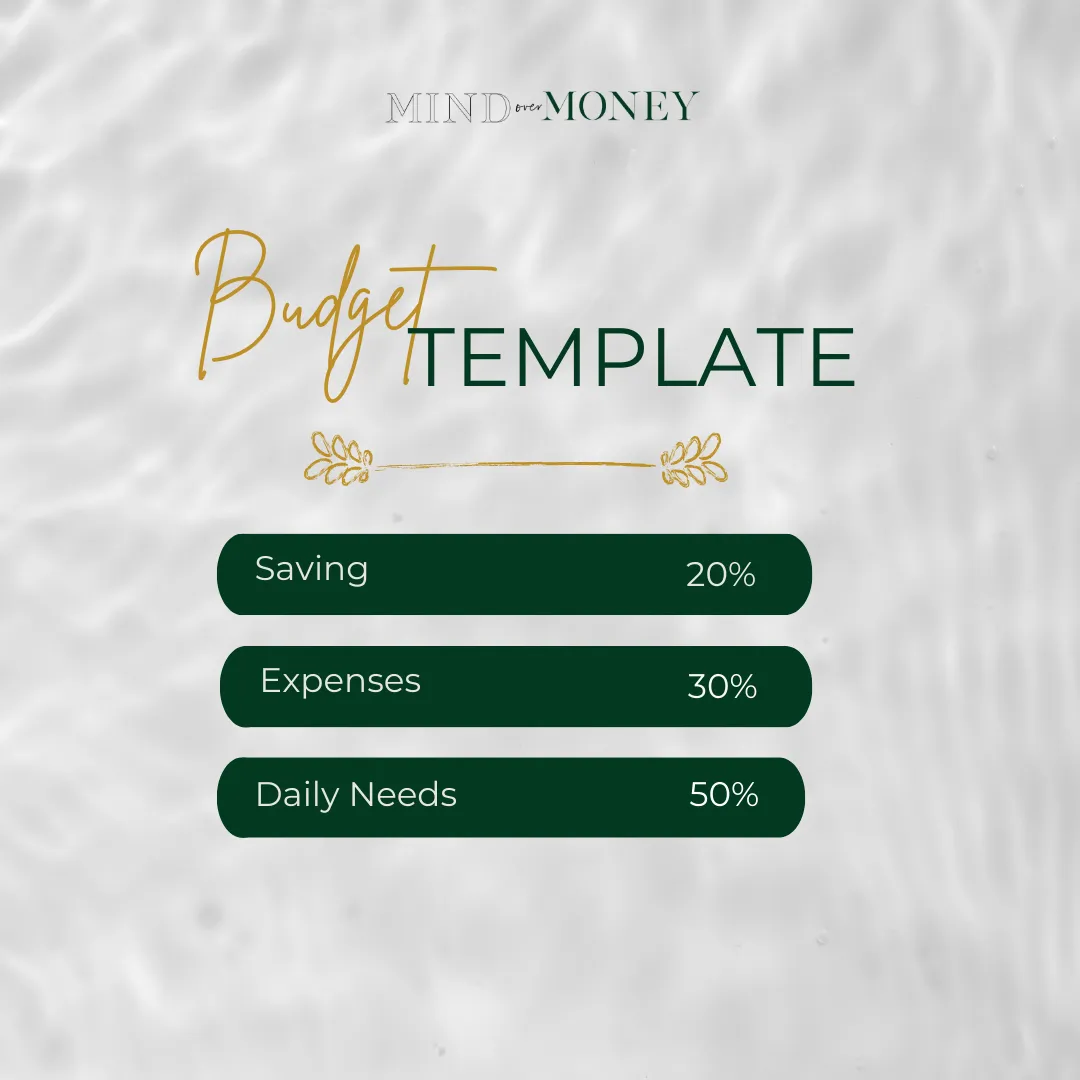

What You"ll Walk Away With

A personalized budget that reflects your real life

A system to track income, bills, fun money, and savings

A monthly plan that doesn’t feel restrictive or boring

A customizable template that’s actually easy to maintain

A plan that supports your long-term goals not just survival

Who is This Workshop For?

People who hate budgeting because it never works for them

Busy professionals and side hustlers who need flexibility

Anyone who wants to manage money without spreadsheets that cause stress

Creatives, educators, parents and anyone craving peace and clarity

Those who want joy and discipline in their financial plan

What You"ll Walk Away With

A bookkeeping system designed for individuals, creatives & small biz owners

Clarity on what to track — income, expenses, taxes, business vs. personal

A simple spreadsheet or app setup you can use right away

Guidance on how to prep for tax season without the panic

Confidence that you’re not leaving money (or deductions) on the table

Who is This Workshop For?

Side hustlers, freelancers, and small business owners

Creatives, consultants, and coaches who aren’t “numbers people”

Anyone who wants to avoid stress when tax time comes

People building wealth and want to manage it like a CEO

What You"ll Walk Away With

A step-by-step savings plan tailored to your income

Creative strategies to free up money without extreme cuts

A progress tracker to help you stay motivated

A safety net that gives you freedom, not fear

Tools to keep your savings growing even after 90 days

Who is This Workshop For?

People who’ve never had a savings cushion and want to change that

Anyone starting from $0 and needing a real plan

Folks recovering from financial setbacks or job changes

Side hustlers looking to stabilize their cash flow

Anyone tired of financial emergencies derailing their peace

Want Unlimited Workshops Each Month?

What's Already in the Vault?

Budget Template

Debt Payoff Template & Calculator

How to Create Your Budget Video Course

Follow The Leader: Copy Congress' Trades Video Course

How to Create Your Debt Payoff Plan Video Course

A Simple Strategy to Begin Investing Video Course

Premier Access

$97/mo

Includes Unlimited On-Demand Access to the Vault

The Vault Includes: Past Trainings, Ebooks, Templates, Finance and Business Resources, & Workshop Recordings

Includes Unlimited Monthly Workshops

Attend every live workshop at no additional cost! Each workshop is a 90-minute deep dive on specific topics such as budgeting, debt payoff, investing, bookkeeping, passive income, and more

Access to 10% For Tomorrow: A Breakthrough Challenge

I started an investment account with zero dollars to document the process of growing and account from scratch with variable income. Each week I invest 10% of my income, share the process and invite you to join in on the journey.

STILL NOT SURE?

Frequently Asked Questions

What is Breakthrough Money School?

Breakthrough Money School is an online education platform designed to give you practical and effective resources that will actually move the needle in your finances.

What results can I expect?

While results depend on your individual effort and financial situation, you can expect to:

✔️ Gain clarity & confidence in your financial decisions for your business

✔️ Create a realistic budget & savings plan that works

✔️ Optimize your taxes, investments, and long-term wealth strategy

✔️ Get rid of debt faster & build a secure financial future

Is this a one-time payment or a subscription?

Breakthrough Money School is a monthly subscription that you may cancel at any time. You have the option to enroll in specific classes using the class pass. Those are one-time payments.

Your Title Here

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.